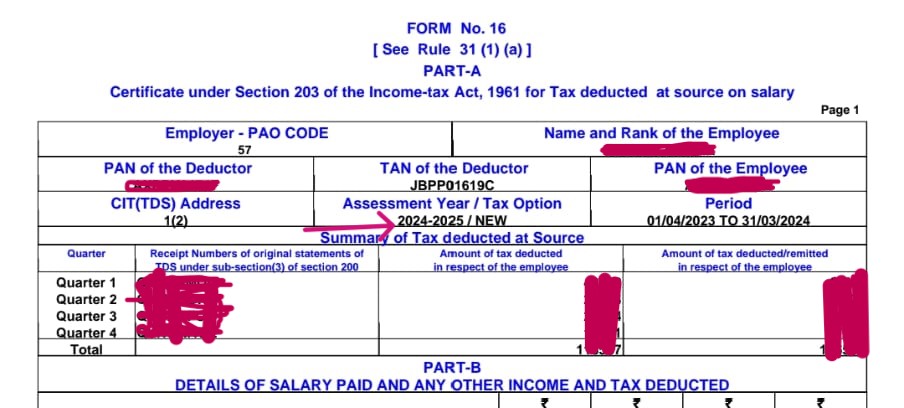

The deadline for filing Income Tax Returns (ITRs) might be behind us, but for those who haven’t filed yet or are planning for next year, here’s a valuable tip: you can use the Account Statement (AS-24) or Form 16 for filing your ITR-1.

The EXEMPT & TAXABLE ALLOWANCE FOR ARMY & SECURITY PERSONAL AS PER INCOME TAX ACT, 1961 are below :-

Fully Taxable Pay & Allowances

| Pay/Allowance Description | Tax Status |

| Pay in the Pay Band | Fully Taxable |

| Basic Pay | Fully Taxable |

| Dearness Allowance (DA) | Fully Taxable |

| Military Service Pay | Fully Taxable |

| Grade Pay | Fully Taxable |

| Non-Practicing Allowance | Fully Taxable |

| Hazard/Special Hazard/Risk Allowance | Fully Taxable |

| Para Allowance/Para Reserve Allowance/Special Commando Allowance/Cobra Allowance | Fully Taxable |

| City Compensatory Allowance | Fully Taxable |

| Deputation (Duty) Allowance | Fully Taxable |

| Technical Allowance | Fully Taxable |

| Qualification Pay | Fully Taxable |

| Special Action Group Allowance (on posting to NSG) | Fully Taxable |

| Technical Pay | Fully Taxable |

| Language Allowance | Fully Taxable |

| Qualification Grant | Fully Taxable |

| Language Award | Fully Taxable |

| Flying Allowance | Fully Taxable |

| Leave Encashment on LTC | Fully Taxable |

| Specialist Allowance | Fully Taxable |

| Test Pilot Allowance | Fully Taxable |

| Instructor Allowance | Fully Taxable |

| Flight Test Allowance | Fully Taxable |

| Security Allowance | Fully Taxable |

| Strategic Force Allowance | Fully Taxable |

| Any pay/allowance not specified anywhere | Fully Taxable |

Fully Exempt Pay & Allowances

| Pay/Allowance Description | Tax Status |

| Gallantry Award | Fully Exempt |

| Foreign Allowance | Fully Exempt |

| Bhutan Compensatory Allowance | Fully Exempt |

| Servant Wages Allowance with BCA | Fully Exempt |

| Purchase of Crockery/Cutlery/Glassware | Fully Exempt |

| Outfit Allowance on posting to Embassy | Fully Exempt |

| Arrears of Cash Grant – Foreign Allowance (Nepal) | Fully Exempt |

| Myanmar Allowance | Fully Exempt |

| Representation Grant for use of crockery set | Fully Exempt |

| Encashment of Leave on retirement | Fully Exempt |

| Outfit Allowance (Initial/Renewal) | Fully Exempt |

| Compensation for the change of uniform | Fully Exempt |

| Kit Maintenance Allowance | Fully Exempt |

| Uniform Allowance (MNS) | Fully Exempt |

| Special Winter Uniform Allowance | Fully Exempt |

| Any payment from Provident Fund | Fully Exempt |

| Payment of Compensation – Disability Pension | Fully Exempt |

Partially Exempt Pay & Allowances

| Pay/Allowance Description | Exemption Details |

| Special Compensatory Allowances (High Altitude, Uncongenial Climate, Snow Bound Area Allowance) | Varies based on location and specific criteria |

| Special Compensatory Allowance in the nature of Border Area Allowance, Remote Locality Allowance, Difficult Area Allowance, or Disturbed Area Allowance | Extent of exemption depends on specific remote or disturbed area designation |

This table format provides a clear and structured overview of the tax status of various pay and allowances for army personnel as per the Income Tax Act, 1961.